Ways To Give

E-Check/Credit/Debit

You have the option of scheduling recurring contributions from your bank account, credit card, or debit card. Card types accepted are Visa, MasterCard, American Express and Discover.

This is the most cost-effective method.

Check

You can make a check payable to the South Carolina Baptist Convention and mail it to: PO Box 212999, Columbia, SC 29221-2999. Please include a completed Contribution Form. You may request one by clicking the button below.

Bill Pay

Bill pay allows your bank to send us a paper check from your bank account. Please include the following information when setting up the transaction so it will be printed on the check:

Recipient Name: South Carolina Baptist Convention

Recipient Address: PO Box 212999, Columbia, SC 29221-2999

Recipient Phone: (803) 765 - 0030

Account Number: [Your 7-Digit Numeric SBC ID #]

Memo Section of the Check: Include a specific designation (i.e. Cooperative Program). This will tell us how to direct your contributions.

Giving Goes Further When We Work Together

The Great Commission isn't the mission of one church or a single believer. It's a collective mission that we fund collectively through the Cooperative Program.

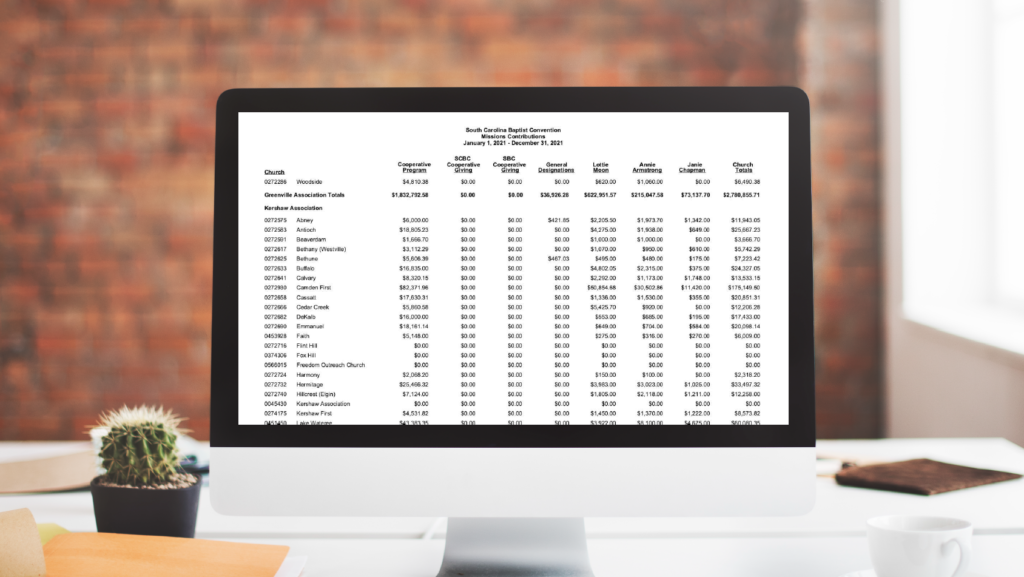

Contribution Reports

Quarterly Giving Statement

A statement of church contributions is mailed to each church treasurer after the close of each quarter and a statement is mailed to the Pastor at the close of the calendar year. You can also request a statement for a particular date range by submitting the form using the button below.

Contribution Form

When contributing by check, please include a completed Contribution Form. We can provide your church with a master copy of the form.

Tax-Exempt Status

If your church contributed to the Cooperative Program through the South Carolina Baptist Convention during the previous calendar year, we can provide you with a 501(c)(3) letter. This letter can be used to prove your exemption from Federal taxes and your Not-For-Profit status with the IRS. Please note that churches are not exempt from paying Sales and Use Tax in South Carolina. Churches may apply for an exemption on items they plan to resale to the public using Form ST-10 and churches may be eligible to limit the amount of sales tax paid on musical instruments and office equipment using Form ST-382. Please visit https://dor.sc.gov for more information.

Church Name Change

Has your church recently changed its name or merged with another church? In order for us to change the name in our database, you need to change the church’s legal name with the IRS.

The South Carolina Baptist Convention is a registered 501(c)(3) organization. Contributions to the South Carolina Baptist Convention are tax-deductible to the extent permitted by law. Our tax identification number is 57-0360087.

Questions? Let's Talk!

For additional assistance, email donations@scbaptist.org, call 803.227.6122, or schedule a time to talk via phone or video.